How will this affect my taxes?

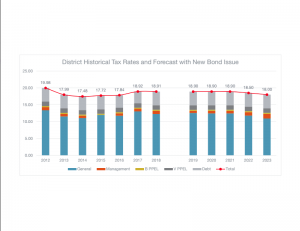

If the bond is passed (60% of voters, vote yes), the bond will be funded using school tax dollars. The current tax rate that school district residents pay will not increase. The number of years that residents will pay that same rate will increase by 5 more years.

| 2033-2038 | 2033-2038 | ||||||

| Residental | Debt Service | Residental | Target | ||||

| **Assessed Value | Levy | Annual Tax | **Assessed Value | Total Levy | Annual Tax | ||

| $100,000 | 4.05 | $205.64 | $100,000 | $18.91 | $960.17 | ||

| $150,000 | 4.05 | $318.28 | $150,000 | $18.90 | $1,485.33 | ||

| $200,000 | 4.05 | $430.93 | $200,000 | $18.90 | $2,010.99 | ||

| $250,000 | 4.05 | $543.57 | $250,000 | $18.90 | $2,536.66 | ||

| $300,000 | 4.05 | $656.21 | $300,000 | $18.90 | $3,062.32 | ||

| $350,000 | 4.05 | $768.85 | $350,000 | $18.90 | $3,587.99 | ||

| $400,000 | 4.05 | $881.50 | $400,000 | $18.90 | $4,113.65 | ||

| **If the bond passes, the 4.05 tax rate will extend through 2038 | |||||||

| ** Assessed Value is NOT taxable value (rollback is used to calculate the taxable value) | |||||||

| Ag Assessed Value Per Acre | Boone County | Story County | Ag Assessed Value Per Acre | Boone County | Story County | |||

| Debt Service | Annual Tax | Annual Tax | Target | Annual Tax | Annual Tax | |||

| Levy | Per Acre | Per Acre | Total Levy | Per Acre | Per Acre | |||

| $4.05 | $4.11 | $3.96 | $18.91 | $19.18 | $18.51 | |||

| $4.05 | $4.11 | $3.96 | $18.90 | $19.17 | $18.50 | |||

| $4.05 | $4.11 | $3.96 | $18.90 | $19.17 | $18.50 | |||

| $4.05 | $4.11 | $3.96 | $18.90 | $19.17 | $18.50 | |||

| $4.05 | $4.11 | $3.96 | $18.90 | $19.17 | $18.50 | |||

| $4.05 | $4.11 | $3.96 | $18.90 | $19.17 | $18.50 | |||

Notes and assumption:

| 3. Agricultural property valuation is based upon the average 2015 taxable value per acre of farmland in the county. | ||||||

| 4. Actual agricultural property valuations may be higher or lower, for an exact answer refer to your property tax assessment. To calculate Agricultural Property Taxes: Take your Productivity (Assessed) Value, multiply by the Agricultural Rollback 46.1068%, and then multiply by the tax rate and divide by 1,000 |